- Loan requests using the word "payday" still seem to be a bad option.

- None of the worst-performing words are used more than a handful of times. The most frequent word in the group, "restaurant", was used in only 0.22% of successfully created loans. Given these small numbers, it's entirely possible that the worst performing words are only that way due to dumb luck. But, given that words like payday seem to have low payout rates both across the years and at other P2P lending sites (my original list of low-paid words at Lending Club) I'm not convinced that this is sheer randomness.

- A few of the worst-performing words seem to have performed poorly year-after-year: "franchise", "operate", "tools", "sincerely", in addition to the aforementioned "payday", and "restaurant".

- None of the most frequently used words really seem to stand out as paying back above or below the average.

Thursday, September 27, 2012

Initial Thoughts on Words in Lending Club Loans

Now that we have an easy way to see statistics for word use in loans on Lending Club it's interesting to see what we can find. A few of the interesting things that I've noticed:

Friday, September 21, 2012

Enhancements to Word Analysis Pages

Today I have uploaded the latest word-analysis data for Lending Club. In addition, I've added:

- A search box to each page

- New special words for:

- [[[[[DOLLAR]]]]] (use of the $ sign in the title or subject), and

- [[[[[PERCENT]]]]] (use of the % sign in the title or subject)

- Index page displays better on the iPad/iPhone

Sunday, September 16, 2012

Index Page and Search Added to Word Analysis Pages

I'm thrilled to see all of the interest in my word analysis. I've just added an index page to the site. Two big things here: a new search box to more easily get to the pages and three 20-word lists covering words with the best payback rate, worst payback rate and most common words used by borrowers.

More changes to come.

More changes to come.

Friday, September 14, 2012

Words with Lends

Today I'm pleased to announce an early version of some word-use analysis pages that I've created for all of the loans successfully funded on Lending Club.

For all words used 50 or more times in the loan title and description I've created a page at http://shoofile.com/loanwords/lendingclub/<word>.html where visitors can find out more information about loans that contain that word.

Here are some examples that I've covered on the blog previously:

For all words used 50 or more times in the loan title and description I've created a page at http://shoofile.com/loanwords/lendingclub/<word>.html where visitors can find out more information about loans that contain that word.

Here are some examples that I've covered on the blog previously:

Also I've added a special "word" for when the Loan Description is blank:

For any word that you'd like to test, you can do so by editing the URL to replace "<word>.html" with whichever word you're curious about.

There are over 2500 words used on Lending Club more than 50 times. For any that aren't used that often you'll get a Not Found error when you look for them.

If this proves popular enough, I'll keep improving the interface to add features like a summary page of the most-used words and a search-box to make finding words easier. I'll also add more details on how I've done the calculations, so that anyone interested can replicate my numbers.

For each topic, a loan is considered to have the word if it appears in the description or subject once or more. I am counting unique loans, so if the borrower wrote the word multiple times, the loan will still count only once. Here's what you get on each report:

- The number of loans using the word per year.

- The percent of loans in currently in each status by year.

- The average grade of all loans containing the word.

- Comparison charts, showing the average payback rate for each loan letter compared to the average payback rate of loans with this word.

For these charts I defined payback rate as: (Paid, Current loans) / (All Loans Except for those with the status Issued)

Update, Sept. 16: I have added an index page to the site here.

Update, Sept. 16: I have added an index page to the site here.

Saturday, September 8, 2012

Veritat Advisors Becomes NestWise on September 10

On Wednesday I, and presumably all Veritat subscribers, received an e-mail stating that the transition to NestWise would be complete this coming Monday, September 10.

The key points:

The key points:

- Your financial advisor won't change.

- Current Veritat members are becoming "charter" members of NestWise, which means:

- Access to Learning Center articles

- Access to Online Classes and Additional Resources

- They are espousing a philosophy of Full Life Financial Management

It will be interesting to see more on Monday.

Prosper Collection Process

One of the things that I like about Lending Club is that they list their attempts to reach out to a delinquent borrower to collect on a late loan.

A week and a half ago Social Lending Network had an article detailing Prosper's collection process. It's nice to see the efforts they're making, too--though I would still appreciate a view into that world, just so that I can see that my interests, as a lender, are being watched out for.

A week and a half ago Social Lending Network had an article detailing Prosper's collection process. It's nice to see the efforts they're making, too--though I would still appreciate a view into that world, just so that I can see that my interests, as a lender, are being watched out for.

Tuesday, July 17, 2012

Veritat Advisors Becoming NestWise

Since I'm in the middle of publishing my 4-part review of Veritat, here's a link that discusses the transition between Veritat and NestWise from Advisorone.com.

It's this paragraph, from the second page, that worries me:

Related: My review of Veritat Advisors.

Part I

Part II

It's this paragraph, from the second page, that worries me:

The second addition will be “professionaly designed managed portfolios,” which are fee-based. “Some will be based on strategists from outside the firm and some will be based on the work of NestWise investment managers,” Stearns said, adding “they will be specifically tailored cost-effective options in this marketplace.”I'm a big fan of indexing and I was specifically looking for a Fee-Only financial advisor. As far as I can tell NestWise hasn't indicated how they'll be operating yet, but I know that if these things disappear I'll end up starting my search for a financial advisor again.

Related: My review of Veritat Advisors.

Part I

Part II

Saturday, July 14, 2012

Veritat Advisors: A Customer's Review - Part II: Fact Finder, Financial Plan and Execution

"Risk comes from not knowing what you are doing." - Warren BuffetIn Part I of my review I explored my initial conversation with Veritat Advisors. In this second part, I have decided to pay $250 for their initial financial assessment. I cover their Fact Finder, where you enter all of your financial data, and the Financial and Execution Plans, which are your advisor's advice for managing your money.

It's worth noting that Veritat has just announced that they are being bought by NestWise LLC, a subsidiary of LPL Financial Holdings Inc. There's not a lot of information available, yet, on what will change along with the ownership, but in a letter sent to customers today we were informed that service will continue and our financial advisor will remain the same.

A Man, A Plan, A Canal. Fact Finder.

|

| The Fact Finder. You'll spend plenty of time here shortly after you pay for Veritat. |

Done well, the Fact Finder will take a couple of hours to complete. During this time you will enter your savings account values, investment account holdings, spending habits, and answer other personal information about your financial life. It can be a bit tedious and I can't help but wonder whether the approach Personal Capital (or, to a lesser extent, Mint) takes might be a better way. Users give Personal Capital login authorization to view their accounts, so information about spending, savings and holdings are all automatically collected--and probably in a more accurate and detailed format than any user would ever enter on their own.* Something like this could make Veritat a one-stop-shop for both daily financial updates (checking credit card and checking statements) and long-term needs (investments and long-term goals.)

|

| See a glaring deficiency here? I didn't--until I completed the Fact Finder. |

Going through the Fact Finder, you may even figure out some of your deficiencies on your own. For me, the most glaring example was the estate planning section (screenshot to the left.) The one page where I had to enter that I've made no effort on a will or health care decisions was enough of a kick-in-the-pants to get me started on those tasks, even without waiting for the planner's advice.

After you've entered your personal and financial information you'll come to the Life Goals section. On my first run through the Fact Finder I set only one goal: the goal to buy a new home in the next few years.

Don't do that.

Instead, think about all of your financial goals and plans that take money and try to summarize them. Do you want to travel every year on a decent vacation? Include that. Do you want to buy a new car every 7 years? Include that. Do you want to save money for your children's college education? Include that, too.

When I first received my financial plan my money was used for buying a home and retirement. Nothing else. Only after realizing my mistake, and then going back and completing a more realistic assessment of my financial goals, did I get a financial plan that would actually work for me in the real world.

My mistake, though, led to one of the most favorable interactions I had with Veritat. It was my advisor who recommended that I add more goals. And my advisor re-did his work when I actually updated those goals. It's worth pointing out that, due to Veritat's pricing model, this did not cost me anything extra. I definitely came away favorably impressed, with the feeling that Veritat is working to set their clients up on a good and realistic path.

Planning and Execution

The payoff for all of your patience entering in financial information is the next two meetings you'll have with your advisor based on all your input. The meetings are centered around two documents, a Financial Plan which you'll receive shortly after your Fact Finder is submitted, and an Execution Plan, which you'll receive shortly after your discussion of the Financial Plan.

The financial plan starts with a dashboard and a summary of your goals. There's a lot of information in the document and, unfortunately, the document itself requires some explaining. That being said, all of my questions were answered on the call with my financial advisor.

Just below is a list of the sections of the feedback, along with a brief description of what is in the section and my thoughts on that section:

While reading the execution plan, before the execution meeting with my advisor, one of my disappointments in the execution plan was that I didn't feel like it was an easy document to work from. It contains a ton of helpful data, but it's a bit hard to pick out a list of tasks that I'll need to do in order to implement my plan.

But then, after the execution meeting, Veritat surprised me. On the website they gave me a list of tasks to complete, outlining everything I was supposed to do and allowing me to fill in the values that I actually used. Seriously, I think these checklists are great and, now that I know they exist, my plan is to use them to go through my tasks and the execution plan to figure out how I'm going to get it done.

*: The disadvantage in the Personal Capital/Mint approach is that you must give the sites your personal log-ins for your savings and investment accounts. While both the sites discuss their security and, I believe, have gone to great lengths to protect their user's data, the payoff for a rogue employee or successful hacker could be in the billions of dollars. That's a big target. And, even while I have been a happy user of Mint for over a year now, this does not set my mind at ease. Giving all of my banking credentials to yet another company is something I'd generally like to avoid. |

| Less red and more green is always good. |

Financial Plan Meeting

Just below is a list of the sections of the feedback, along with a brief description of what is in the section and my thoughts on that section:

Dashboard: A high-level overview of whether or not you are on track for your goals (see the screenshot to the right, as well as the one just above that.)

The Dashboard

Showing how much change is necessary,

and whether or not I can reach my goals.- Goal Summary: This is a list of all of your goals, when they will happen, the minimum and maximum dollar estimate you need to make the goal happen, your priority for the goal and the recommendations that come from your financial plan. When you get the financial plan it will be worthwhile to check and see that your goals are all there and adequately funded. I know that I looked at mine and realized that some priorities that I thought were High were actually Medium or Low, and vice-versa.

Lifetime Net Worth: This is a page showing a projection for how your investments and assets will appreciate over time. My advisor warned that it's not very accurate--meaning, I believe, that the year-by-year aspect of the projection could be very inaccurate, but if historical trends continue my investments might grow something akin to what is indicated.

Lifetime Net Worth: This is a page showing a projection for how your investments and assets will appreciate over time. My advisor warned that it's not very accurate--meaning, I believe, that the year-by-year aspect of the projection could be very inaccurate, but if historical trends continue my investments might grow something akin to what is indicated.- Budget: A high-level overview of your income, expenses and savings for the rest of the current year and the entire next year. Honestly, this page was just confusing to me--even after explanation I still struggle to understand it. Fortunately, it's an overview page, so it's not that important in the scheme of things.

- Recommended Saving and Debt Repayment: This is the first real page of substance in the financial plan. It contains your goals, how much of your current money you're going to allocate to them, how much you're going to save for them in the remainder of the current year, and how much you will save for them in the next year. The specifics of how you will do this and where you will put the money will be covered in the execution plan later. Right now we're just looking at how much and when.

Investment Portfolio: For each of your investment accounts there is a pie chart showing your current and recommended allocation of stocks and bonds. Your advisor will ask you what funds are available in your investment accounts and make recommendations based on those choices. That happens outside of the Planning and Execution documents.

The recommended change to my portfolio allocations.

I've been a very aggressive investor and it's probably

time for me to settle down a bit.- Investment Implementation: Like the Recommended Saving and Debt Repayment page, this page will show you how much to be saving in each investment account over the year, along with a more specific breakdown of the target portfolio (large cap, small cap, international, bond, cash.)

- Insurance Portfolio: Includes coverage recommendations for life insurance, accidental death & dismemberment, and long-term care insurance. My advisor stated that it's a start to the insurance conversation, but not the final picture. I am informed that the calculation used for life insurance is the Net Present Value (NPV) of that person's income along with debt repayment. For me, personally, this is too high as I don't want my wife to have too big a reason to put me out of her misery. For single income families and other situations this figure might be much more reasonable.

Estate & Will: A page dedicated to your eventual demise. Here you'll see the four documents Veritat thinks you should have and whether or not you should complete them. It's worth noting that Veritat also recommends companies you can use to complete the forms. And, since Veritat should not be making any money from these companies because they are fee-only planners, I am generally of the impression that they are decent companies at low cost.

I knew I had the wrong answers!

Execution Plan and Meeting

Once you and your financial planner have gone through and verified the financial plan, your advisor will have you schedule an execution plan meeting. Honestly this is the most exciting part: this is the document that will guide all of the changes you are about to make to your investments. Once again, I'll go through section-by-section:

- Risk Management: This section had helpful tips on how to set up insurance, estate, and will documents. Veritat recommended providers and gave specific information that you would need to insure yourself appropriately. This information should make it relatively easy and convenient to set up the documents with these services, though I think a truly prudent investor will do at least a quick search of competitors insurance rates, as well.

- Future Goals: This section summarizes your goal spending for the remainder of this year and all of next year, shows how much is allocated for that goal, and informs you which account the money will be taken from.

- Portfolio Action Plan: A summary, for this year and next, of saving, spending and transfers to and from each account.

- Transaction Plan: A list of money to save, money to transfer and rebalances to perform on each of your accounts over the course of this year and the next. This is the bulk of the execution plan.

- Portfolio Management: A reminder about Veritat's portfolio management service. I declined the service and, to their credit, never felt any pressure to join.

- Disclosures and Summaries: There's actually a lot of good information in the summaries of the companies that Veritat recommends here.

| One of my checklist tasks. |

Summary

And so I can truthfully report that I have been pleased with my initial experience with Veritat. I do feel like I've gotten my money's worth for my financial plan, both in direction and the efforts of my financial planner. I'm pleased enough that I'm planning to stay on as a monthly subscriber for at least another half year, to see if I continue to derive value from their service--although my plans may change as they merge and transition to NestWise. (Part IV of my review will discuss either the reason I left Veritat/NestWise during the transition or my impression on how worthwhile the $40/month service and quarterly meetings are if the transition goes smoothly.)

In Part III of my review I'll do a brief look at the advice I received from Veritat and how it compares to the do-it-yourself financial site bogleheads.org, but for the many of us who don't want to spend hours thinking about our finances, Veritat seems like a great way to go. If you've been considering using a financial advisor I would definitely try Veritat first. It won't cost you much, compared to an in-person advisor, and it might just cover everything you need.

The Good

- My financial advisor recommending that I add more goals, even though it made more work for him.

- The final checklist of actions I received from Veritat was top notch and will be useful for reporting what I actually did, since it might vary a bit from their recommendations.

- Throughout the experience I have learned a lot and feel like I am working towards a more secure financial future.

The Bad

- The Financial Plan and Execution Plan are difficult to interpret without assistance.

The Ugly

- The time spent gathering accounts and the initial data for the Financial Plan.

- The length of this post.

Friday, July 13, 2012

LendStats Filters Down

Bummer. From KenL, creator of LendStats:

and

It's too bad. LendStats has been a great resource for the community and helped me, personally, with my returns on Prosper and LendingClub. Additionally, LendStats has one of the best P2P forums on the net--with participants who are genuinely thoughtful and helpful.

Ken, thank you for all of the work you've put into LendStats. I have certainly appreciated it. I'm sad to see the feature go, but I certainly understand the desire to move on. Good luck in whatever you choose to focus on next!

My original goals with LendStats were to find out what the real returns were and to figure out how p2p lending could be profitable for lenders (remember people... there was a time when p2p lending was not profitable for lenders). Both of those goals and a whole lot more have been accomplished. So I feel no urgency to get the filters up and running again. Also with all the negativity out there aimed at LendStats, I'm really not that interested in keeping things going anymore. I was working on LendStats largely because I found it fun, but the fun has slowly disappeared and with that so has my motivation to keep working on the site.

and

I'm just tired of it, and I don't feel like wasting my time and energy anymore. And after 3 years if LendStats is still in an embryonic state, then I guess I really should call it quits.

It's too bad. LendStats has been a great resource for the community and helped me, personally, with my returns on Prosper and LendingClub. Additionally, LendStats has one of the best P2P forums on the net--with participants who are genuinely thoughtful and helpful.

Ken, thank you for all of the work you've put into LendStats. I have certainly appreciated it. I'm sad to see the feature go, but I certainly understand the desire to move on. Good luck in whatever you choose to focus on next!

Tuesday, July 10, 2012

Veritat Advisors: A Customer's Review - Part I: Trial and Free Assessment

"There are known unknowns. That is to say there are things that we now know we don't know. But there are also unknown unknowns. There are things we do not know we don't know." - Donald RumsfeldI've slowly come to realize that, in regards to my finances, I have no idea what I'm doing. Yes, I scrimp and save. Yes, I max out the company match on my 401k. But beyond the basics, I have many questions. Worse yet, the more I learn the more I realize that I know nothing.

So I seek advice. And after a long, grueling internet search for local financial advisors, contemplation about fee-only advisors and advisors from an investment house, and the idea to just ask on some intelligent financial forums, I decided to try the online firm Veritat Advisors.

I'm wary, though. While there are many articles covering Veritat's introduction to the internet, I was hard-pressed to find many reviews by actual customers*.

Veritat had piqued my curiosity, though, and the initial financial review, at $250, wasn't going to break the bank. So I decided to give them a shot and write about my experience as a paying customer. So, without further ado, part one of my review of Veritat Advisors:

14 Day Free Trial

The Website

During the free trial, the most interesting thing you can do is to browse Veritat's Learning Center. I was pleasantly surprised by the documents there. They struck me as easy-to-understand jumping-off points for the topics they covered. They are organized both by topic and by life event. Covered topics include things like "How Much Life Insurance Do You Need" and "Alternatives to Using Long-Term Care Insurance." Covered sections include "Starting A Family"and "Caring For An Aging Parent." The articles here aren't particularly deep discussions of the topic, but I think many people will be able to find some good helpful hints in this section.

Financial Assessment

I was actually pleasantly surprised. While the financial assessment document was not useful in itself, it was a good jumping-off point for a conversation about what sort of advice I was looking for and what the company offers. I was pleased with the conversation with my financial advisor and, more importantly, I felt like he was completely open about the scope of their services. When I asked about options beyond Veritat's scope of service there was no hemming or hawing. I was informed that they wouldn't be much help with those questions and, in some cases, I was guided to a better source to answer my questions.

|

| The meat of the Financial Assessment. |

Honestly I would have liked to see Veritat go farther with the assessment. Obviously they can't make amazing judgements based off of the limited information they collect during the free trial period, but I would think that they could do a quick "you might benefit from..." or "you might try to avoid..." section. These sections could be personalized to discuss some of the common pitfalls people encounter while striving to achieve the goals the client picked during the assessment.

The Story So Far

After the free assessment I had a choice to make: did I want to pay Veritat to develop a full financial plan or did I want to be done with them? I was still curious and satisfied enough with my initial conversation with them that I decided to move forward and purchase the Financial Plan (a one-time cost of $250.) In Part II, I'll write about the process of coming up with a Financial Plan, including entering data into the Fact Finder, the Financial Plan I received, and the Execution Plan I've been asked to follow.

My summary of the free trial:

The Good

- Learning Center documents are helpful overviews of financial topics.

- The initial conversation with my advisor was direct and honest when he talked about what Veritat could and couldn't do for me.

The Bad

- The free Financial Assessment document seems like a waste of time. I'm certain they could do something better, even with the limited information they have.

The Ugly

- That worry that you're going to spend 15 minutes getting a hard sell.

Update: As I've been writing this review, Veritat has announced that they are being bought by NestWise LLC, a subsidiary of LPL Financial Holdings Inc. There's not a lot of information available, yet, on what will change along with the ownership, but in a letter sent to customers today we were informed that service will continue and our financial advisor will remain the same.

Thursday, May 17, 2012

Lending Club Fixes Marketing Issue

In my previous post I commented on an issue Lending Club had with its marketing materials. In their latest update of the data (available here,) Lending Club has fixed the error:

Saturday, May 12, 2012

Lending Club's Marketing Falsehood

Update: Lending Club has refreshed the values for May and has corrected the issue. The original article follows:

It seems like a minor quibble, but I certainly worry whenever I see a company where I invest money make mathematical mistakes in their marketing materials.

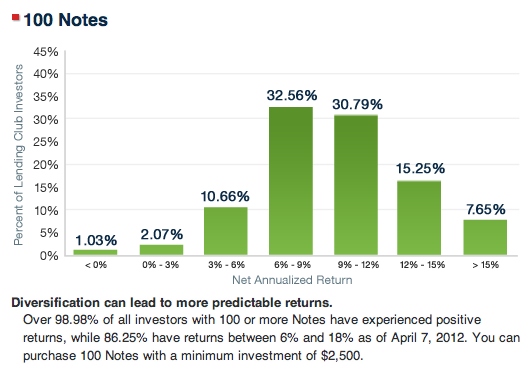

Today I was browsing Lending Club's Diversification page, looking at the graphs for 100 notes and 400 notes. Both contain a similar inaccuracy:

It seems like a minor quibble, but I certainly worry whenever I see a company where I invest money make mathematical mistakes in their marketing materials.

Today I was browsing Lending Club's Diversification page, looking at the graphs for 100 notes and 400 notes. Both contain a similar inaccuracy:

Lending Club states that "Over 98.98% of all investors with 100 or more Notes have experienced positive returns" and yet they show that 1.03% of investors have <0% returns.

It's the word "over" that is inaccurate here, and the inaccuracy comes down to a rounding issue. But "over" is a marketing word that translates to a specific mathematical meaning: greater than 98.98%. And that simply can't be true if the number of <0% returns rounded to 1.03%.

Following conventional rounding rules, the minimum percentage that the 1.03% of <0% returns could actually be is 1.025%.

Being generous with the word over, let's assume in this case that there are 98.98% positive returns.

98.98% + 1.025% = 100.005% which is, of course, impossible.

Lending Club's statement is false. Under 98.98% of all investors with 100 or ore Notes have experienced positive returns. If they want to use the word "over" they must change the value to over 98.97%.

Yes, it's small, but it's a way to demonstrate that everyone in the organization, right down to the marketing folks, really understand the importance of the numbers to us lenders and are committed getting us great returns that are mathematically sound, not ones that just sound good.

Lending Club's 400 Notes image suffers from the same issue:

Subscribe to:

Comments (Atom)