It seems like a minor quibble, but I certainly worry whenever I see a company where I invest money make mathematical mistakes in their marketing materials.

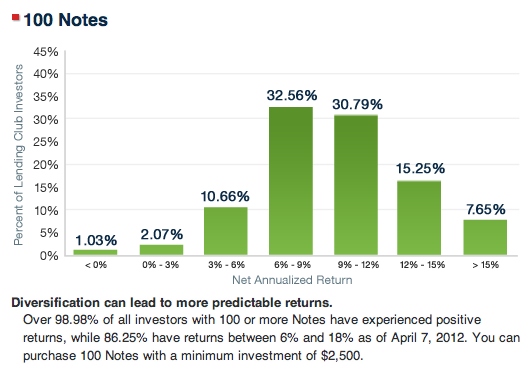

Today I was browsing Lending Club's Diversification page, looking at the graphs for 100 notes and 400 notes. Both contain a similar inaccuracy:

Lending Club states that "Over 98.98% of all investors with 100 or more Notes have experienced positive returns" and yet they show that 1.03% of investors have <0% returns.

It's the word "over" that is inaccurate here, and the inaccuracy comes down to a rounding issue. But "over" is a marketing word that translates to a specific mathematical meaning: greater than 98.98%. And that simply can't be true if the number of <0% returns rounded to 1.03%.

Following conventional rounding rules, the minimum percentage that the 1.03% of <0% returns could actually be is 1.025%.

Being generous with the word over, let's assume in this case that there are 98.98% positive returns.

98.98% + 1.025% = 100.005% which is, of course, impossible.

Lending Club's statement is false. Under 98.98% of all investors with 100 or ore Notes have experienced positive returns. If they want to use the word "over" they must change the value to over 98.97%.

Yes, it's small, but it's a way to demonstrate that everyone in the organization, right down to the marketing folks, really understand the importance of the numbers to us lenders and are committed getting us great returns that are mathematically sound, not ones that just sound good.

Lending Club's 400 Notes image suffers from the same issue:

No comments:

Post a Comment